Listen to this article

Browser text-to-speech

Introduction

George Soros is a towering figure among global financiers, known for his keen investment insights, economic knowledge, and political engagement. Born in Budapest, Hungary, on August 12, 1930, Soros’s early life, marked by war and political strife, molded his future endeavors in both finance and philanthropy. His resilience in a tumultuous environment fueled a career path characterized by bold strategies and significant impact. Soros’s trajectory took him from Europe to the bustling financial sector of the United States. He established Soros Fund Management in 1970, giving rise to the Quantum Fund, a symbol of growth and profit💡 Definition:Profit is the financial gain from business activities, crucial for growth and sustainability.. Central to Soros’s investment success was his Theory of Reflexivity, which contradicted prevalent economic beliefs and enabled him to exploit market inefficiencies. Beyond the financial realm, Soros has actively contributed to philanthropy and global political deliberations, championing open societies and democratic governance through the Open Society Foundations, while attracting controversies. In 1992, Soros’s short position💡 Definition:A short sale is selling an asset you don't own, aiming to profit from a price drop. on the British pound became a defining moment in financial history, showcasing his capacity to convert economic and geopolitical analyses into profitable investments. Soros’s methodologies and thinking have left a lasting imprint on the investment world, continuing to inspire many to decode his market insights. For those seeking greater understanding of Soros’s impact and legacy💡 Definition:Inheritance is assets passed to heirs, crucial for financial stability and legacy planning., comprehensive resources are available, including scholarly discussions on his influence.

Early Investing Influences

George Soros’s investment acumen was shaped by early influences and pivotal experiences, from his education at the London School of Economics (LSE) to various formative roles in finance. At LSE, philosopher Karl Popper’s concept of an “open society” profoundly impacted Soros’s ideals, instilling a critical approach to market norms. His first job at Singer & Friedlander introduced him to international arbitrage, laying the foundation for his future exploits. Soros’s stint at F.M. Mayer in New York exposed him to the market reflexivity concept, which would become integral to his investment framework. These early experiences combined philosophical thought with practical finance, creating the groundwork for his revolutionary Theory of Reflexivity. For a detailed account of Soros’s journey and how it influenced his business savvy, various in-depth sources are available.

The Theory of Reflexivity

Soros’s Theory of Reflexivity is a cornerstone of his investment ideology, challenging the conventional view that markets are rational and self-balancing. Reflexivity suggests a reciprocal influence between market perceptions and economic realities, resulting in deviations from classical economic predictions. This theory elucidates the cyclic interplay between market sentiment and fundamental economic factors, which can cause markets to veer dramatically from equilibrium, leading to booms and busts. Soros leveraged Reflexivity to identify “mispriced” investments, capitalizing on divergences between market views and actual fundamentals. His intuition for market psychology allowed for notable triumphs, including his pivotal trade during the Black Wednesday UK currency crisis. Reflexivity extends its relevance beyond financial markets to the socio-political domain, reflecting Soros’s broader intellectual pursuits. His exploration of Reflexivity in market behaviors offers critical insights for investors and market participants alike.

Soros’ Investment Strategies

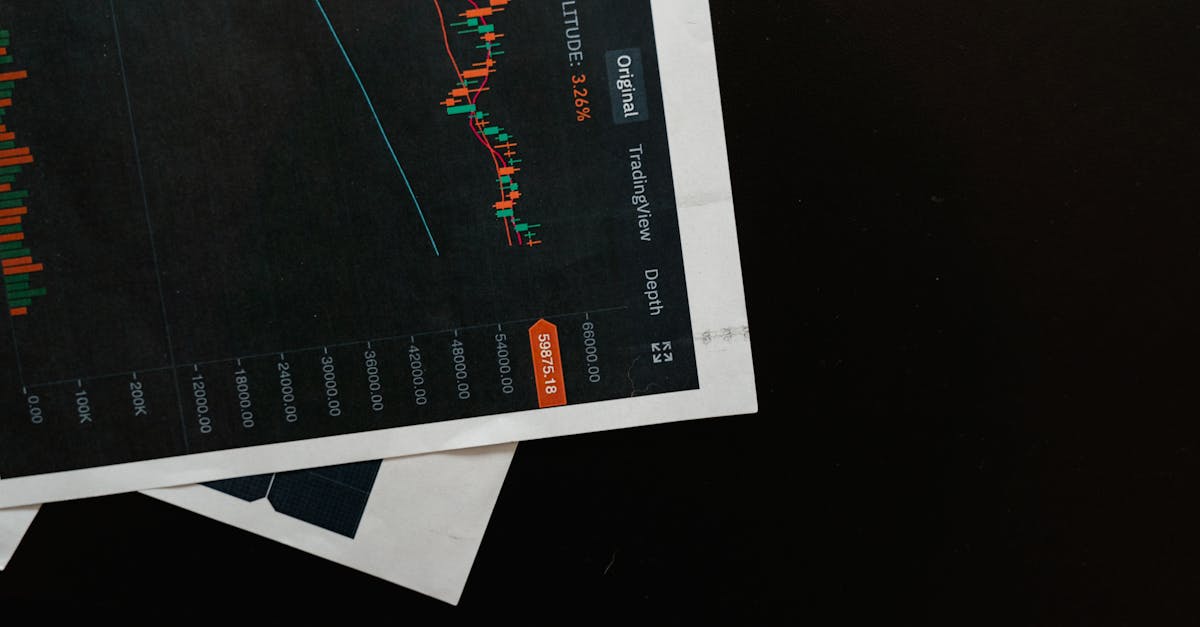

The investment strategies of George Soros, characterized by active engagement and speculative insight, contrast with the passive investment ethos held by some of his contemporaries. His macroeconomic perspective allows him to identify and leverage💡 Definition:Leverage amplifies your investment potential by using borrowed funds, enhancing returns on your own capital. global economic trends, eschewing individual company performance in favor of large-scale economic shifts. Soros’s speculative moves are informed by rigorous research into political and economic contexts, resulting in landmark successes such as the 1992 British Pound speculation. He is particularly recognized for daring currency trades that have significant economic repercussions, exemplified by his actions during the early ’90s. Risk and uncertainty💡 Definition:Risk is the chance of losing money on an investment, which helps you assess potential returns. are integral to Soros’s investment philosophy. Embracing high-stakes ventures, Soros operates under principles that wouldn’t typically align with the majority of investors. While his approach has faced criticism for being potentially destabilizing, it’s essential to comprehend the extensive research and calculated risk-taking that underpin his strategy. For those interested in Soros’s investment methods, it’s crucial to appreciate the risks and in-depth analysis intrinsic to his approach. Resources are available for those wishing to explore Soros’s strategies and their practical application.

Criticisms and Controversies

George Soros is a polarizing figure in the financial and philanthropic worlds, attracting both admiration and incendiary criticism. His aggressive trading, especially the notable 1992 bet against the British pound, has faced scrutiny for its potential to unsettle national economies and currencies. Soros’s philanthropy, funneled through the Open Society Foundations, has also drawn accusations of political interference, highlighting tensions around the intersection of philanthropy and political influence. Additionally, Soros’s political contributions in the US have spurred debate concerning the impact of private wealth💡 Definition:Wealth is the accumulation of valuable resources, crucial for financial security and growth. on political discourse. The backlash Soros has received for profiting during financial crises, such as the Asian financial turmoil in 1997, underscores the criticism faced by investors who are perceived to take advantage of economic vulnerabilities for personal gain. Despite the contention surrounding his persona, Soros’s legacy includes significant theoretical and practical contributions to economic and societal spheres.

Legacy and Impact

Soros’s influence extends from reshaping investment approaches to challenging economic thought with his Theory of Reflexivity. His financial foresight has driven pivotal moments in history, such as the Black Wednesday crisis. Additionally, his philanthropic work through the Open Society Foundations has sought to advance democratic institutions and social equality globally. While Soros’s career has been mired in controversy, from his market operations to his political activity, his imprint on financial and political narratives is indelible. Soros personifies the union of market acumen and activism, illustrating the potential for financial insight and strong principles to effect widespread change. His story serves as a reminder of the power individual actions can wield in shaping economic and social landscapes worldwide.

See what our calculators can do for you

Ready to take control of your finances?

Explore our free financial calculators and tools to start making informed decisions today.

Explore Our ToolsRelated Tools

Continue your financial journey with these related calculators and tools.

Roi Calculator

Open this calculator to explore detailed scenarios.

Asset Allocation

Open this calculator to explore detailed scenarios.

Investment Risk Stress Test

Open this calculator to explore detailed scenarios.

Portfolio Rebalancer

Open this calculator to explore detailed scenarios.